Beyond Expectations: Unveiling Senior Living Consumer Demands for 2024

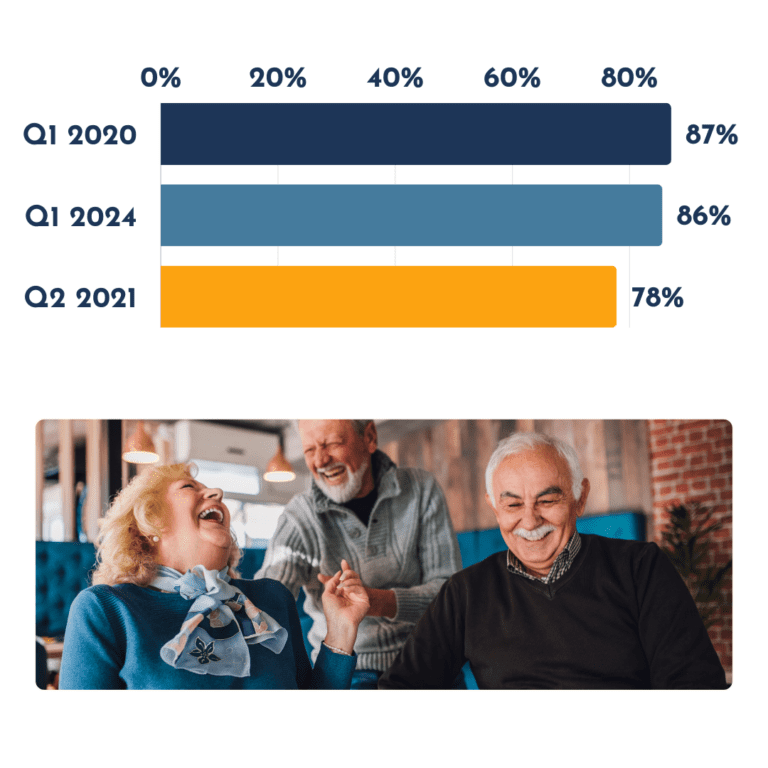

The senior living industry often faces challenges in meeting the evolving needs of prospective residents and their families on topics like affordability and quality of care, all of which impact occupancy. The current occupancy rate for senior housing properties averaged 85.6% in Q1 2024, down from the pandemic occupancy high of 87.1% in Q1 2020, but significantly improved from the all-time industry low of 77.8% in Q2 of 2021, post-pandemic.1

The substantial interest, however, comes with its own set of challenges. Potential residents and their families are likely considering multiple options, making it crucial for communities to differentiate themselves in a crowded market. To capitalize on this interest, providers must prioritize their marketing and outreach efforts. Every interaction with a potential resident or family member should serve as an opportunity to showcase unique value propositions, whether through specialized care services, innovative amenities, or a particularly engaging community atmosphere.

This high engagement rate indicates that communities should be prepared for a constant stream of inquiries and tours. This necessitates well-trained staff and efficient processes to handle increased interest. Communities that can quickly and effectively respond to this demand may gain a significant competitive advantage.

The data also reflects broader demographic trends, as the aging baby boomer population fuels demand for senior living options. As this trend continues, we can expect to see further evolution in the types of services and amenities that seniors and their families prioritize. Communities that can adapt to these changing needs while offering unique, high-quality experiences are likely to thrive in this dynamic and growing market.

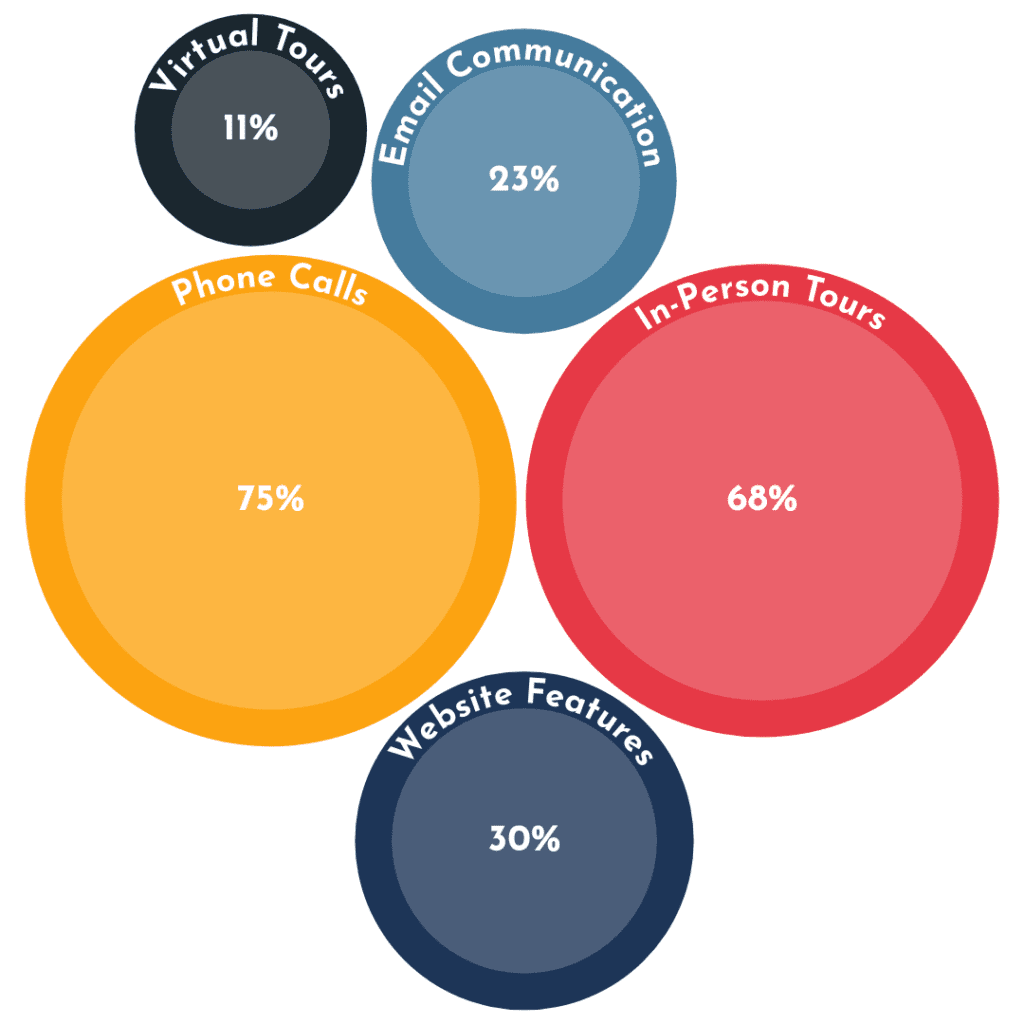

Digital engagement is reshaping how seniors and their families connect with living communities, though traditional methods still dominate the landscape. Our survey reveals a multi-channel approach to community engagement, with 30.1% of respondents using website features, 23% using email, and 10.8% participating in virtual tours. Despite this digital shift, phone calls (74.8%) and in-person tours (68.4%) remain the most popular methods of contact, highlighting the enduring importance of personal interaction in the senior living decision-making process.

This evolving mix of communication channels reflects the diverse preferences of today’s seniors and their families. The persistence of traditional contact methods underscores the need for well-trained staff who can effectively handle phone inquiries and conduct in-person tours. Similarly, staff must be equipped to respond promptly and professionally to email inquiries, which represent a significant portion of initial contacts.

The growing use of digital methods indicates that senior living communities need to invest in user-friendly websites with features like chat functions, detailed information pages, and high-quality virtual tour capabilities. They should also ensure their email communication is prompt, informative, and personalized. These digital tools, including email, can serve as a crucial first step in the decision-making process, allowing potential residents and their families to gather information and narrow down their options before making direct contact.

As technology adoption among seniors continues to grow, and as more digital-savvy families begin inquiring about senior living for their parents, an even greater shift towards digital-first communication strategies should be expected in the coming years. This includes not only website features but also email communication to bridge the gap between traditional and fully digital methods. The key to success will likely lie in balancing these digital innovations, including email, with the personal touch that many seniors and their families still value highly.

Moreover, the multi-channel nature of engagement suggests that communities should strive for consistency across all touchpoints. Whether a potential resident reaches out via phone, email, visits in person, or engages online, they should receive the same high-quality information and positive experience. This cohesive approach to communication, integrating both traditional and digital methods including email, can help build trust and credibility throughout the decision-making process.

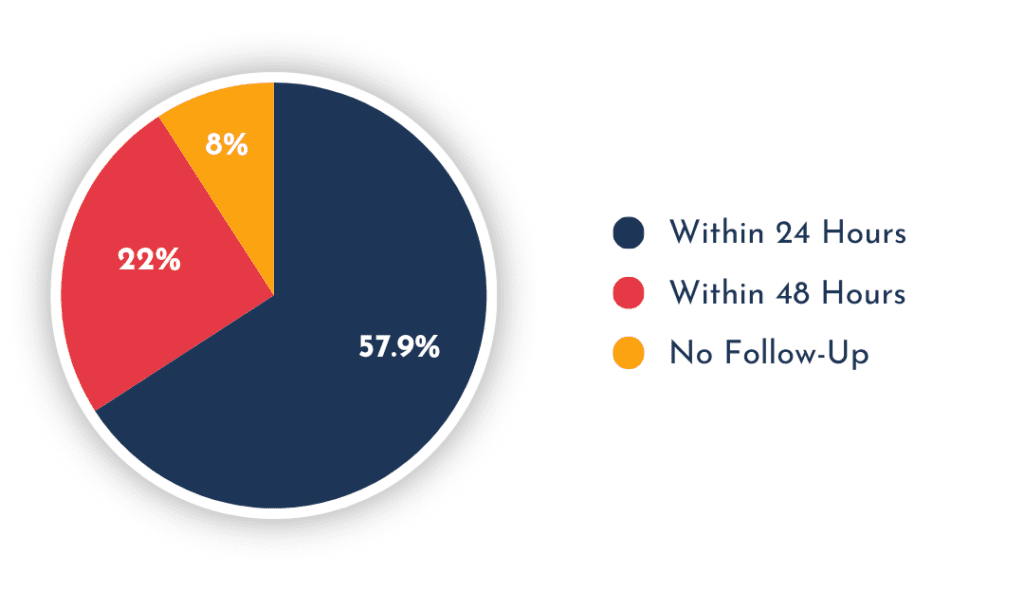

The importance of prompt follow-up in capturing potential residents is evident from our survey results. A majority of communities (57.9%) demonstrated commendable responsiveness by following up within 24 hours or one business day. This quick response time is crucial in an industry where decisions often involve emotional factors and time sensitivity.

However, there’s significant room for improvement, as 22% of respondents reported follow-up within 48 hours, and alarmingly, 8% reported no follow-up at all. In a competitive market, these delays or lack of follow-up represent missed opportunities and potential loss of residents to more responsive communities.

The data suggests that implementing a systematic, prompt follow-up process could be a significant competitive advantage. Communities might consider leveraging Customer Relationship Management (CRM) technology to ensure no inquiry falls through the cracks and to track the entire communication process with potential residents.

Moreover, the quality of follow-up is as important as its timeliness. Staff should be trained not just to respond quickly, but to provide valuable, personalized information that addresses the specific needs and concerns expressed during the initial contact.

It’s also worth noting that different contact methods may require different follow-up strategies. For instance, an inquiry through a website form might warrant an immediate automated response followed by a personal contact, while a phone call might be best followed up with another call or an email summarizing the conversation.

By prioritizing prompt, personalized, and consistent follow-up communications, senior living communities can significantly enhance their chances of converting inquiries into residents, ultimately driving occupancy rates and business success.

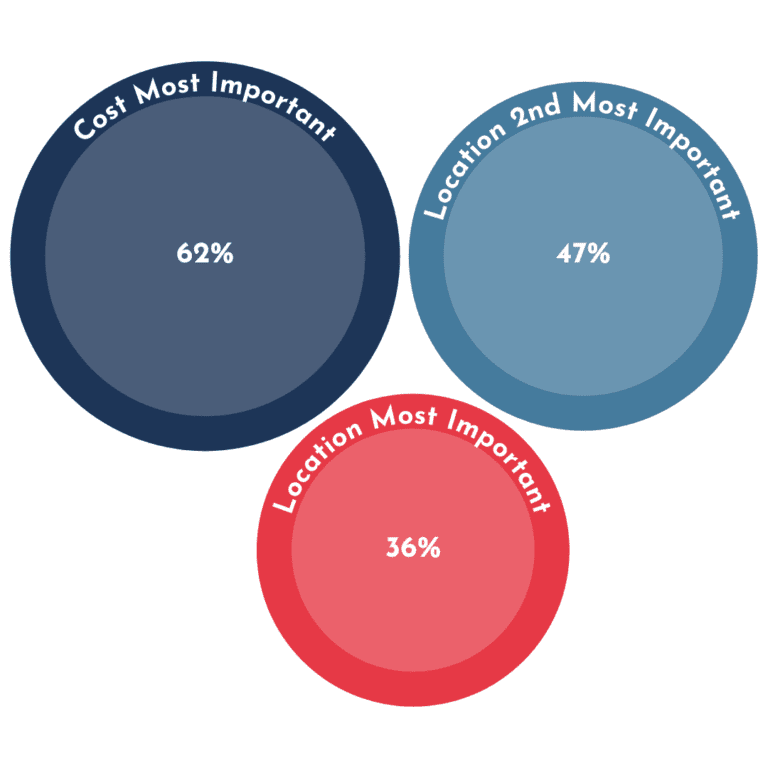

Our survey reveals a complex decision-making process when it comes to selecting a senior living community, with cost and location emerging as the top priorities. A substantial 62% of respondents ranked cost as the most important factor in their decision-making process. Location was the second most critical factor, with 35.8% ranking it as most important and 47.2% as the second most important.

These findings highlight the delicate balance families must strike between finding quality care and managing financial constraints. The primacy of cost in the selection process underscores the need for communities to clearly communicate their value proposition. Transparent pricing structures and detailed breakdowns of included services can help potential residents and their families understand the full scope of what they’re paying for.

Location’s high ranking as a selection factor highlights the desire of many seniors to remain close to family, friends, and familiar surroundings. For communities, this emphasizes the importance of highlighting proximity to family, healthcare facilities, or cultural attractions in their marketing materials.

While cost and location topped the list, other factors such as care quality, amenities, and staff engagement also played significant roles in the decision-making process. This suggests that while communities may not be able to change their location, they can differentiate themselves through exceptional care, innovative programs, and a warm, engaging atmosphere.

Interestingly, pet-friendliness was ranked as least important by 71.3% of respondents. While this suggests it’s not a primary concern for the majority, it could be a decisive factor for a significant minority. Communities might consider offering pet-friendly options as a way to differentiate themselves without necessarily making it a core feature of their offering.

These findings suggest that senior living communities need to strike a balance between affordability, desirable location, and high-quality services to appeal to the broadest range of potential residents. Communities that can effectively communicate their value proposition in terms of cost, highlight their convenient location, and showcase their quality of care and amenities are likely to be most successful in attracting and retaining residents.

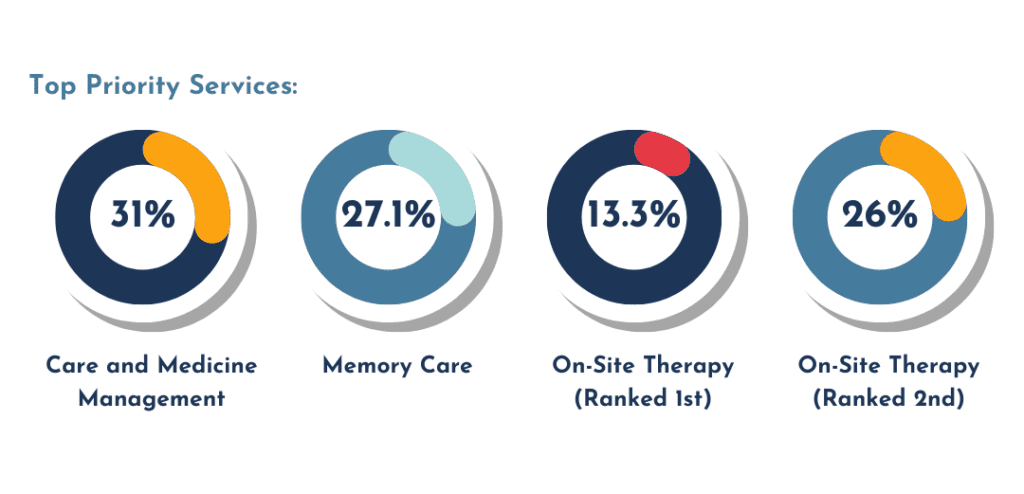

Care and medicine management emerged as the top priority, with 31% of respondents ranking it as the most important service. Memory care followed closely at 27.1%, reflecting the growing awareness of cognitive health issues among seniors. On-site therapy was also highly valued, with 13.3% ranking it as most important and 26% as the second most important.

Interestingly, amenities like movie theaters and swimming pools showed a polarized response. While 22.6% ranked them as most important, 28.4% considered them least important. This split suggests an opportunity for communities to differentiate themselves based on their target demographic’s preferences.

The survey also revealed that incontinence care and laundry/housekeeping services, while important, were not top priorities for most respondents. Only 0.5% ranked incontinence care as most important, while 5.6% prioritized laundry/housekeeping services.

These preferences highlight the evolving expectations of senior living residents and their families. Communities that excel in these areas may find themselves at a competitive advantage. However, the diversity of priorities suggests that a one-size-fits-all approach may not be effective.

This diverse range of priorities underscores the need for senior living communities to offer flexible service packages that can be tailored to individual needs and preferences.

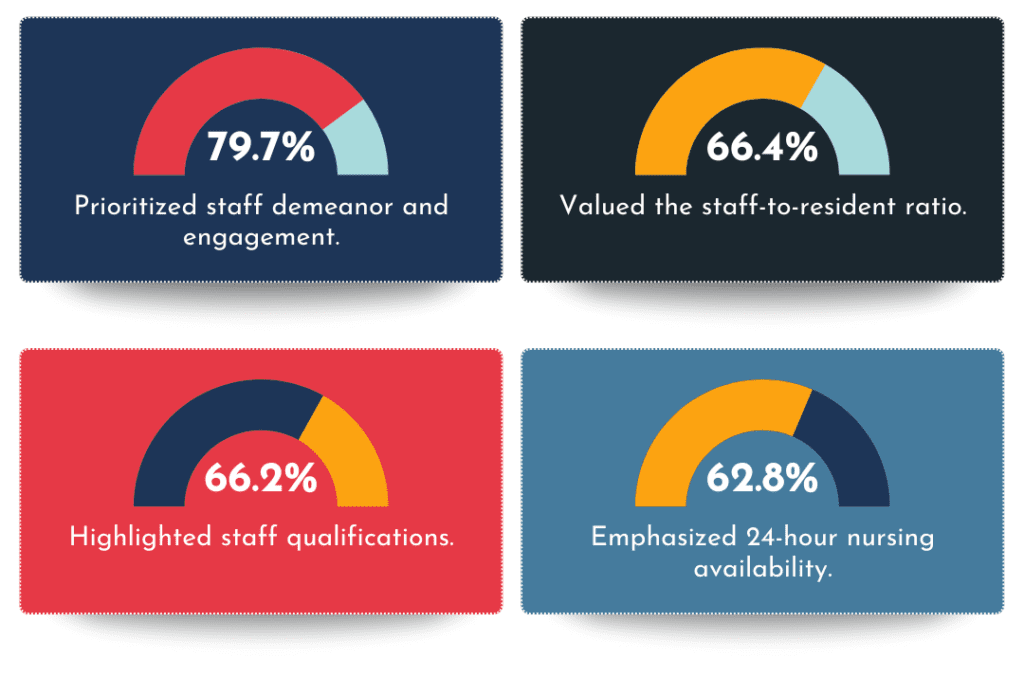

The importance of staff in shaping the senior living experience cannot be overstated. An overwhelming 79.7% of respondents cited staff demeanor and engagement with residents as the most crucial factor. This was followed by the ratio of staff to residents (66.4%) and staff qualifications (66.2%). The availability of 24-hour nursing staff was also highly valued (62.8%).

These findings underscore the human element in senior care. While state-of-the-art facilities and cutting-edge amenities are valuable, it’s the day-to-day interactions with staff that often define a resident’s experience. Communities should prioritize staff training programs that emphasize empathy, engagement, and professional development.

The high importance placed on staff-to-resident ratios suggests that potential residents and their families are concerned about the level of individual attention available. Communities might consider highlighting their staffing levels and personalized care approaches in their marketing materials.

The strong emphasis on staff qualifications (66.2%) indicates that families are looking for assurance of professional, high-quality care. This could be an area for communities to differentiate themselves by showcasing their staff’s expertise, certifications, and ongoing training programs.

The high value placed on 24-hour nursing staff availability (62.8%) reflects the desire for round-the-clock professional care. This is particularly important for residents with chronic health conditions or those who may need emergency assistance at any time.

Overall, these findings suggest that investing in a well-trained, engaged, and sufficient staff could be one of the most effective ways for senior living communities to attract and retain residents.

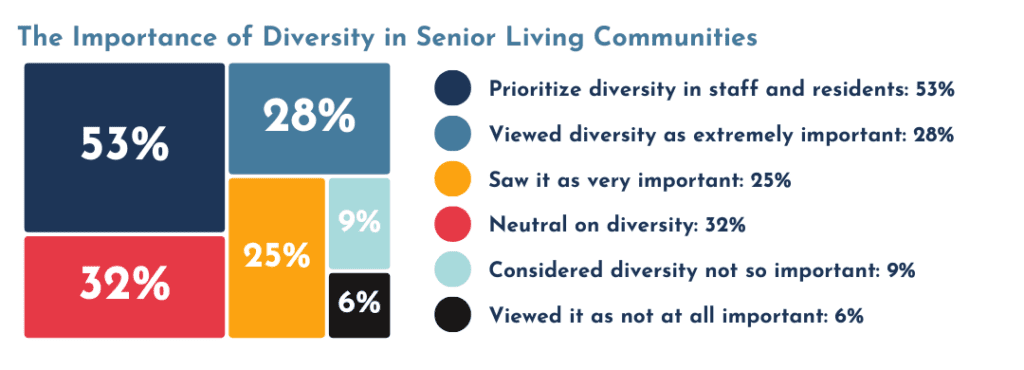

Our survey revealed a growing emphasis on diversity, with 52.7% of respondents considering diversity in staff and residents important or very important. Specifically, 28.1% viewed it as extremely important, and 24.6% as very important. This trend reflects broader societal shifts towards recognizing and valuing diversity.

For senior living communities, this presents both a challenge and an opportunity. Communities that can create a diverse, inclusive environment may find themselves appealing to a broader range of potential residents. This could involve not just ethnic and cultural diversity, but also diversity in terms of life experiences, interests, and abilities.

However, it’s worth noting that 31.9% of respondents were neutral on this issue. Additionally, 9.1% considered it not so important, and 6.4% viewed it as not at all important. This suggests that while diversity is increasingly important, it may not be a deciding factor for all potential residents. Communities should strive for inclusivity while also focusing on other key factors that drive decision-making.

8. Likelihood of Moving to a Senior Living Community

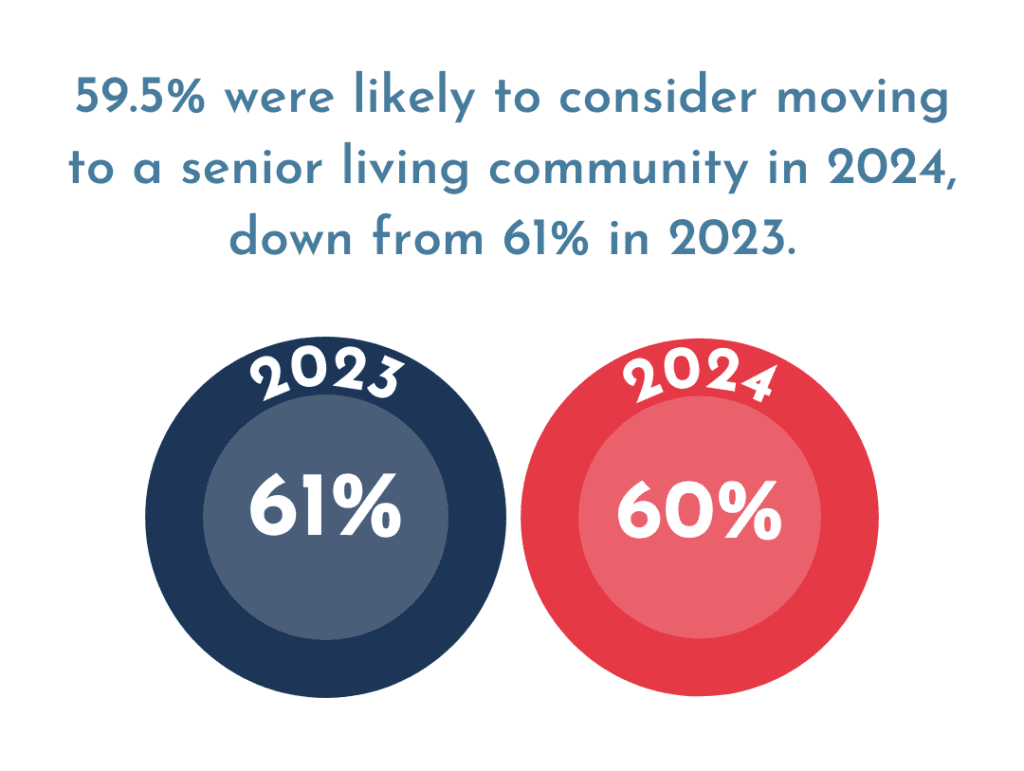

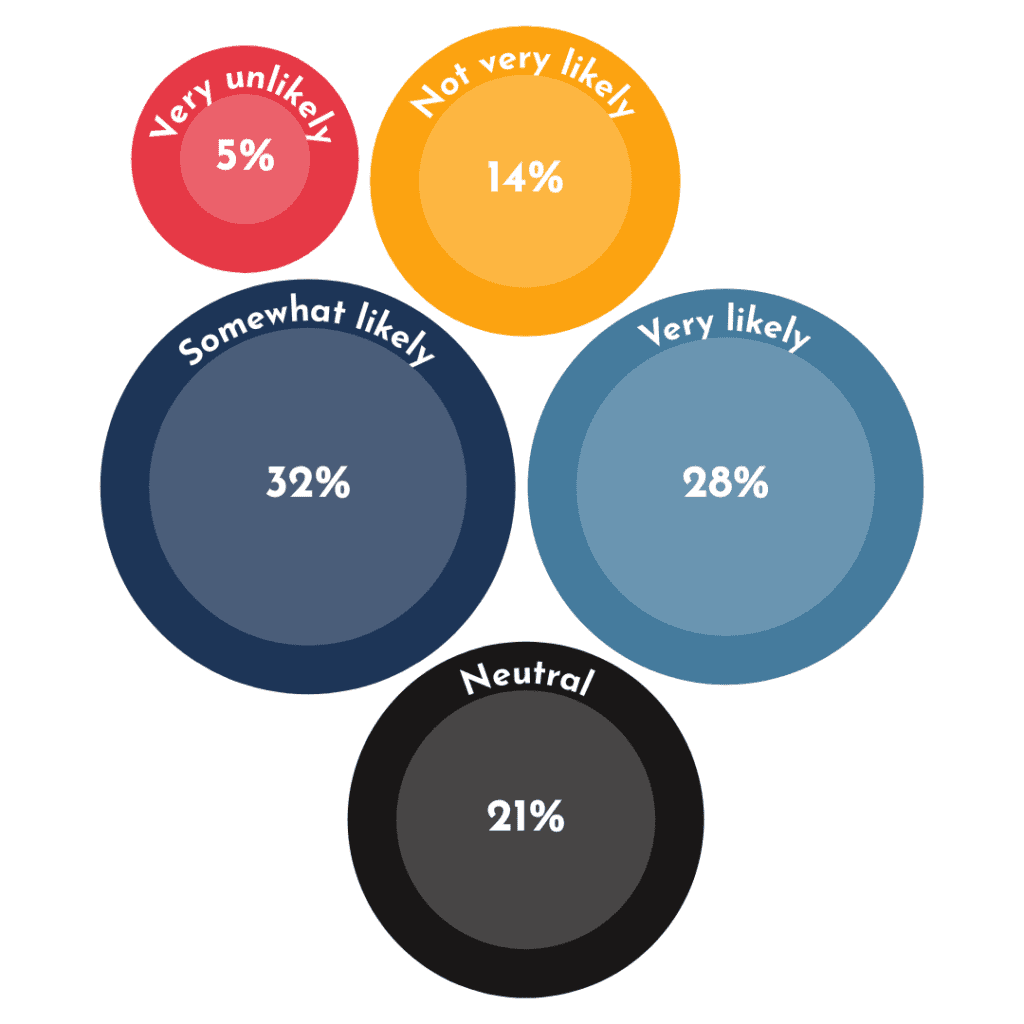

Our year-over-year comparison revealed a slight decrease in the likelihood of moving to a senior living community. In 2024, 59.5% of respondents indicated they or someone they know were likely to consider such a move, down from 61% in 2023.

Breaking this down further, 27.9% were very likely and 31.6% were somewhat likely to consider moving to a senior assisted living community in the near future. However, 21% remained neutral, while 14.2% were not very likely and 5.3% were very unlikely to consider such a move.

While this decrease is small, it could signal a shift in attitudes towards senior living options. It may reflect growing interest in aging-in-place solutions or alternative care arrangements. For senior living communities, this trend underscores the need to clearly communicate their value proposition and the benefits of community living.

The data also suggests an opportunity for communities to address common concerns or misconceptions that might be deterring potential residents. This could involve more transparent communication about costs, care quality, and lifestyle benefits.

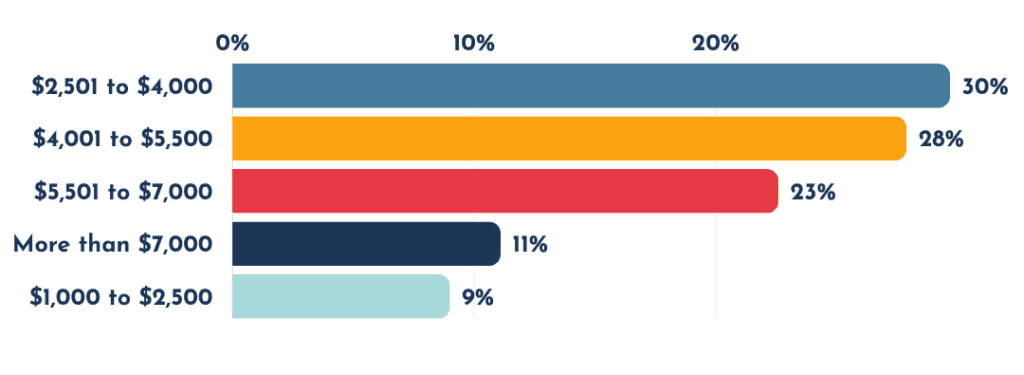

Perceptions of assisted living costs remained remarkably stable year-over-year. In both 2023 and 2024, approximately 58% of respondents estimated monthly costs between $2,501 and $5,500.

Our survey provided more detailed insights into cost perceptions. 29.7% of respondents expected monthly costs between $2,501 and $4,000, while 27.9% anticipated costs between $4,001 and $5,500. A significant portion (22.6%) expected higher costs between $5,501 and $7,000, and 11.1% anticipated costs exceeding $7,000. Only 8.9% expected costs to be as low as $1,000 to $2,500.

This consistency in perception presents both challenges and opportunities for senior living communities. On one hand, it suggests that pricing strategies aligned with these expectations may be well-received. On the other hand, it indicates that efforts to educate the public about the true costs and value of senior living have not significantly shifted perceptions.

Communities may need to refine their messaging around costs, perhaps by breaking down the value provided by various services and amenities. Transparency in pricing and clear explanations of what’s included could help potential residents better understand the cost structure.

Our survey revealed a slight increase in the expectation of using self-pay for senior living expenses. In 2024, 37.6% of respondents expected to self-pay, up from 33% in 2023. Expectations for using health insurance or Medicare also saw a small increase, from 35% to 36.3%.

Additional insights into payments revealed 17.5% of respondents anticipated using long-term care insurance, while only 2.4% expected to use veterans benefits. Notably, 6.2% indicated “Other” payment methods. Many respondents indicated a need to combine multiple payment options to afford senior living costs, underscoring the financial complexity of this decision.

This shift towards self-pay expectations could reflect growing awareness of the limitations of Medicare and other insurance programs in covering long-term care costs. It may also indicate a need for more education about payment options and financial planning for senior living.

For communities, this trend suggests an opportunity to provide more robust financial planning resources and guidance. Partnerships with financial advisors or the development of in-house expertise could help potential residents navigate the complexities of funding their senior living experience.

11. Alternative Care Options

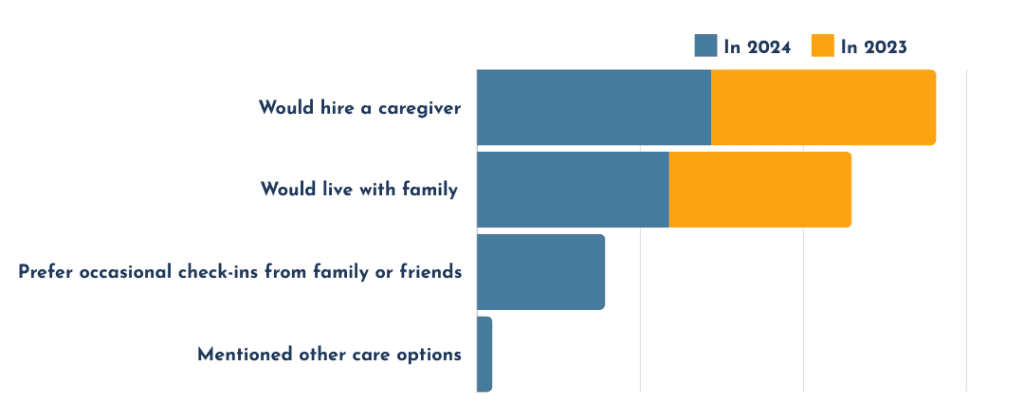

We observed a growing openness to alternative care options. The consideration of hiring a caregiver increased from 69% in 2023 to 71.8% in 2024, while the option of living with family rose from 56% to 58.9%.

Our survey provided more detailed insights into alternative care preferences. 71.8% of respondents would consider hiring a caregiver or Home Health Agency, while 58.9% would consider living with a family member. Additionally, 39.3% were open to doing the best they could with occasional check-ins from family, friends, or neighbors. 4.7% mentioned other options, including daytime activities.

This trend presents a clear challenge to traditional senior living communities. It suggests that potential residents are increasingly aware of and interested in options that allow them to remain in familiar environments.

To compete effectively, senior living communities may need to emphasize their unique benefits, such as 24/7 professional care, social engagement opportunities, and the ability to maintain independence while receiving necessary support. Communities might also consider developing hybrid models that incorporate elements of home care or create transitional programs to ease the move from home to community living.

12. Desired Improvements and Innovations

Respondents provided a wealth of suggestions for improvements in senior living communities. Key themes included enhanced staff training, improved cleanliness, more diverse and engaging activities, better dining experiences, and increased technology integration.

These suggestions offer a roadmap for innovation in the senior living industry. They indicate that while basic care needs are crucial, residents and their families are increasingly looking for a higher quality of life and a more engaging, stimulating environment.

Communities that can successfully implement improvements in these areas may find themselves at a competitive advantage. This could involve investing in staff development programs, reimagining activity calendars, upgrading dining services, or integrating smart home technologies to enhance resident comfort and independence.

Charting the Future: Adapting to Evolving Senior Living Preferences

The senior living landscape is undergoing a significant transformation, driven by changing demographics, evolving consumer expectations, and technological advancements. Our survey reveals a complex picture of senior living preferences in 2024, marked by a desire for high-quality, personalized care balanced against concerns about cost and a growing interest in alternative care options.

For senior living communities, these findings underscore the need for adaptability and innovation. Success in this evolving market will likely hinge on the ability to provide transparent, flexible pricing models, deliver exceptional, personalized care, and create engaging, technology-enabled living environments. Moreover, the emphasis on staff quality and diversity highlights the ongoing importance of the human element in senior care.

Ongoing research and adaptation will be crucial as the senior living industry continues to evolve. By staying attuned to changing consumer preferences and proactively addressing emerging trends, senior living communities can position themselves to meet the needs of current and future residents, ensuring both their own success and the well-being of the seniors they serve.

Ready to enhance your communities’ appeal?