Beyond Surveys: A Deep Dive into Customer Experiences and the Path to Brand Loyalty

In today’s competitive landscape, building emotional connections with customers is the key to fostering long-term loyalty that goes beyond transactional rewards and discounts. Our latest market research report, “Beyond Surveys: A Deep Dive into Customer Experiences and the Path to Brand Loyalty,” delves into the factors that drive exceptional customer experiences and uncovers actionable insights to help your brand create meaningful, lasting relationships with your customers. Our report collected insights from 3,242 respondents across three independent studies in the following areas:

Key insights include:

Feedback Behaviors

- Customers are most likely to provide feedback when expectations aren’t met, but also share feedback when expectations are exceeded or they have constructive criticism.

- Survey length, ease of access, and rewards motivate participation, while an omnichannel approach reaches more customers.

- 45% of customers who have a negative experience provide feedback within a day, showing the need for rapid response.

Recovery Opportunities

- Poor product/service quality is the #1 trigger for negative feedback, followed by unresolved issues.

- 57% have changed negative feedback to positive after a satisfactory resolution, however 29% reported having never received a resolution to their issue.

- Customers ranked assurances of corrective actions taken as most likely to win back their business after a poor experience, over alternatives like discounts, apologies, or refunds.

Loyalty Drivers

- Exceptional experiences build emotional connections, with quick response time, knowledgeable staff, and problem resolution being top-ranked elements.

- 80% choose better customer experience over cheaper pricing, and 71% chose it over a more convenient location.

- Hotels, restaurants, retail, and eCommerce are recognized leaders in customer experience.

Key recommendations include implementing integrated multi-channel feedback systems, setting rapid response protocols, empowering staff through customer-focused KPIs, closing the resolution loop with customers, and building a customer experience-centric culture.

While customer surveys provide helpful insights, the most candid feedback comes through ongoing tools facilitating private sharing outside a sales-focused lens. Simple text-based polls sent in the moment, for instance, may receive higher response rates and detail than lengthier email surveys. By covering key touchpoints with quick questions using the communication channels each customer prefers, participation rises. Keeping the back-and-forth dialogue open through prompt and respectful acknowledgment further drives authentic sharing. Fundamentally, listening beyond surface impressions to understand customers’ underlying needs, then demonstrating actions taken, keeps building durable trust. Implementing regular channels that enable two-way interaction ultimately shapes an experience centered around customers’ truths.

I. CUSTOMER EXPERIENCE LANDSCAPE

The customer experience a brand delivers has increasingly become a competitive advantage that drives consumer choice and loyalty across industries. 60 percent of consumers have purchased something from one brand over another based on the service they expect to receive (Zendesk).

To drive customer experience (CX) transformation, data and insights into the end-to-end journey must shape every touchpoint. This report analyzes multi-dimensional research consisting of three customer surveys related to CX behaviors, pain points, and loyalty perceptions. Key insights uncovered provide a valuable competitive advantage in strategically improving CX initiatives holistically.

II. RESEARCH METHODOLOGY

The research conducted aimed to deeply explore three core areas of the customer experience:

1. Customer Experience Survey Likelihood

2. Triggers Behind Negative Experiences

3. Loyalty Drivers and Preference for Brands Offering Exceptional Experiences

This exploratory research was conducted through three online surveys with 3,242 total responses. Respondents represent the average consumer across a variety of demographics. Surveys were distributed via email in Q3 2023.

Survey 1 focused on customer feedback behaviors and propensity to complete customer experience surveys, collecting 1,096 responses related to drivers, methods, and barriers that impact providing feedback.

Survey 2 targeted detractor triggers and recovery opportunities, with 780 customers responding to experiences causing negative feedback and satisfactory resolution.

Finally, Survey 3 explored exceptional experiences and loyalty motivators through 1,366 customer responses.

This aggregated multi-survey approach allows analysis into different elements across the customer journey to identify targeted areas for improving CX strategies.

III. DETAILED FINDINGS

Key insights uncovered across the three surveys are highlighted below, structured around three main categories:

A. Customer Experience Survey Likelihood

B. Triggers Behind Negative Experiences

C. Loyalty Drivers and Exceptional Experiences

A. Customer Experience Survey Likelihood

The first survey focused on general customer feedback behaviors and preferences that shape engagement, response rates, and brand sentiment.

Activities That Spark Brand Feedback

On average, respondents were likely to complete a survey 77% of the time after interacting with their favorite brands. Understanding key drivers that motivate customers to provide feedback is critical for boosting response rates. When asked under what circumstances customers are most likely to give feedback, the top triggers were:

1. Experience falling short of expectations (36%)

2. Greatly exceeded expectations (32%)

3. Having constructive criticism (21%)

This indicates the majority of feedback shared is prompted by moments in the journey that stand out either very positively or very negatively compared to anticipated experiences. Brands should focus CX strategies on soliciting constructive criticism from a majority of customers to drive incremental improvements, rather than solely trying to appease an angry minority with unmet expectations. When soliciting feedback, questions should target both constructive input to improve as well as uncovering exceptionally positive moments that connect customers emotionally to the brand and provide an opportunity to recognize superstar employees.

Motivation Stimulation

Getting customers to not only provide feedback but provide high-quality, thoughtful input hinges on motivational factors. Survey findings showed that shorter survey length, ease of access, and offering a reward contribute greatest to likelihood of responding.

Best practices would be to design bite-sized surveys focused only on key diagnostic questions while promotion encourages participation through ease of access via popular channels.

Incentives and rewards connected to valuable feedback motivate engagement while allowing customers to feel heard.

Gaps in Soliciting Authentic Feedback

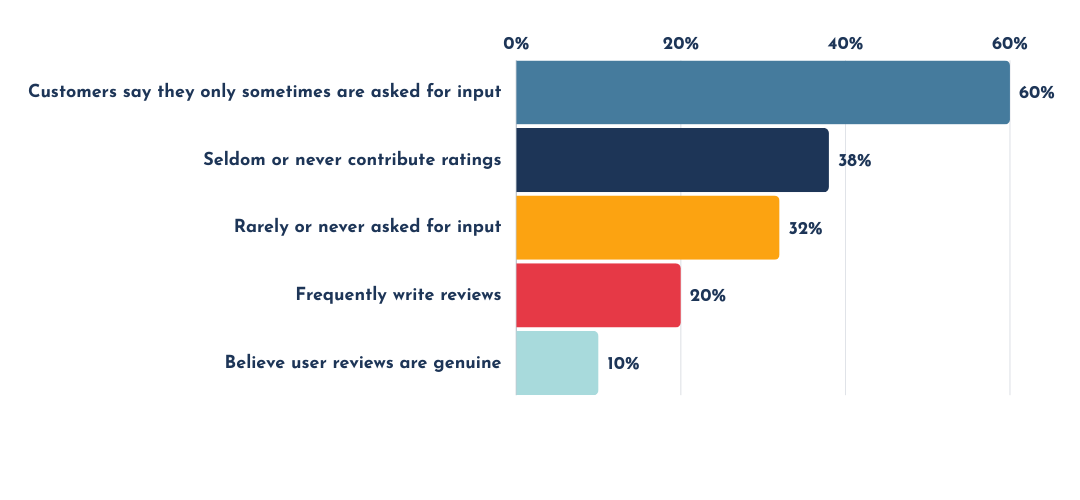

Employees inconsistently invite feedback, with 60% of customers saying they only sometimes are asked for input and 32% rarely or never asked. Clearly staff solicitations alone cannot capture insights in a reliable, proactive manner.

Additionally, while online reviews do play a moderate role in participation choosing establishments, review sites predominantly feature an angry minority, not the majority view. Just 20% frequently write reviews while 38% seldom or never contribute ratings. Of that minority sharing online input, only 10% perceive most user reviews as genuinely authentic reflections of experiences.

Over half believe reviews posted capture true sentiments only some of the time. This disconnect means review results alone disproportionately broadcast fringe impressions from customers facing issues or having atypical interactions rather than balanced views.

Resolution Evaluation

Finally, 87% stated implementing a universal yet simple and private feedback method would make them more likely to share input. Closing the loop with customers by letting them know action taken based on their feedback is also highly valuable. Lack of visibility into resolution was a common complaint decreasing motivation and trust.

Key Takeaways:

→ Promote feedback for constructive and emotional moments

→ Motivate survey effort through simplicity, convenience, and rewards

→ Employees and review sites alone insufficiently capture balanced feedback from the true customer majority

→ Build trust and transparency through 2-way communication of the resolution processes

B. Triggers Behind Negative Experiences

While positive feedback shapes incremental improvements, negative experiences have an outsized influence in destroying customer confidence and loyalty. Survey 2 honed in on frequent detractor triggers and optimal recovery approaches.

Negative Experience Frequency

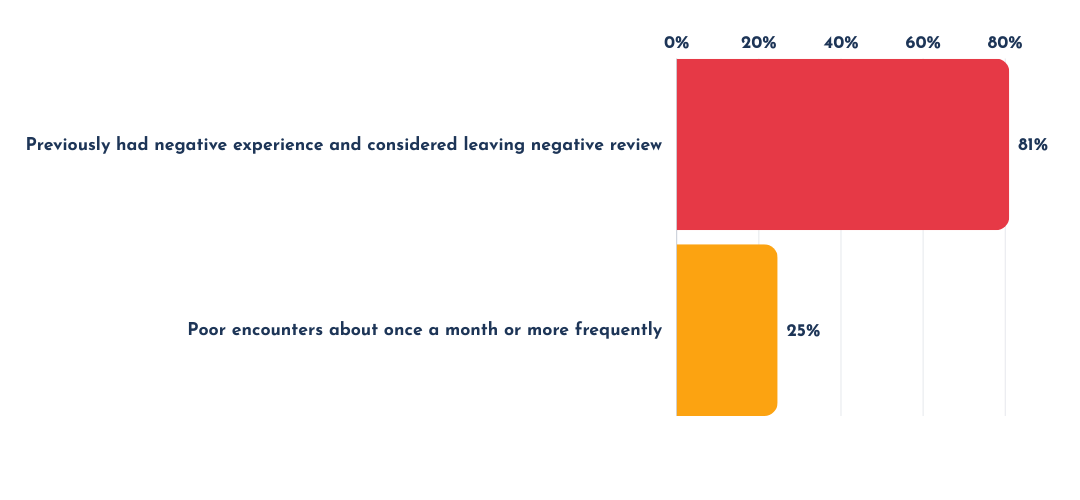

The survey found that an overwhelming majority of 81% of respondents – almost 4 out of 5 – have previously had a negative experience that made them consider leaving negative feedback or a review. 24.6% have these poor encounters about once a month or more frequently.

Pain Point Prioritization

When asked to rank factors prompting negative feedback, the top pain points were:

- Miscommunications, with 648 total responses ranking it the top two factors influencing negative feedback

- Inadequate customer support, with 194 responses ranking it the top two factors influencing negative feedback

- Long wait times/delays, with 227 responses ranking it the top two factors influencing negative feedback

This indicates brands must implement always-on feedback channels facilitating two-way communication to proactively understand customer sentiment and perceptions in real time. By capturing input during frontline interactions, organizations gain visibility into what underlies negative impressions and rapid response in addressing miscommunications, delays, or support deficiencies evident.

Ensuring designated staff are tasked with monitoring feedback and equipped to reach out for additional clarity from the customer when details seem misaligned or lacking helps brands enable facts-based root cause evaluation. This helps clarify associations between emerging pain points and operational disconnects. For example, identifying consistently breached service time expectations or support training issues help brands target the right process or training changes required to meet customer expectations more often.

Furthermore, providing transparency to customers by acknowledging opportunities to improve through a two-way communication channel can close gaps that hinder brand trust and loyalty, even in the face of periodic friction.

Customer Feedback Habits and Preferences

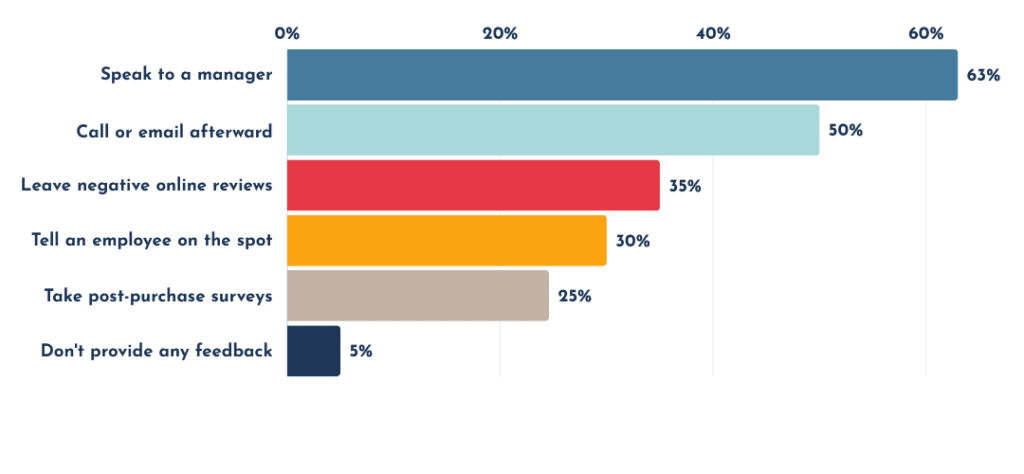

Regarding how customers provide negative feedback and expectations around response, out of 780 total responses where respondents can choose all answers that apply:

- 63% speak to a manager

- 51% take post-purchase surveys

- 50% call or email afterward

- 30% tell an employee on the spot

- 35% leave negative online reviews

- 4% don’t provide any feedback

Today, if customers have a negative experience, their options are typically confronting an employee publicly in the moment, engaging in an awkward manager discussion afterward, or blasting frustrations online. The former causes the customer to make the uncomfortable choice of calling out issues face-to-face and risks potential embarrassment in the moment. It is therefore understandable why so many customers resort to leaving negative feedback on social media or by way of online reviews.

Furthermore, while 63% discuss issues with managers, vital context may be lost in sharing this feedback with upper management, which is often crucial to implementing company-wide change. This problem is exacerbated when employees handle the most immediate fires without manager involvement or the right tools to capture actionable data at scale.

With another 30% indicating they don’t take post-purchase surveys, the absence of this structured channel limits brand insights into common pain points self-reported by one-third of customers.

Additionally, 37% avoid speaking to staff altogether, and online complaining has emerged with 35% now taking frustrations straight to public online channels.

These gaps risk constructive feedback becoming siloed at the frontlines, leaving higher up CX decisionmakers unaware, when they are the ones with the resources to prioritize the improvements customer segments request most often. Additionally, most survey tools used today capture limited data with their formats. Simple 1-5 scales or angry/neutral/happy icons fail to capture the insightful or constructive feedback received from open-ended comments.

Timeliness of Feedback Shared

Customers tend to provide negative feedback soon after a poor experience, with 45% sharing complaints within 1 day and more than 25% doing so within mere hours of the incident. This indicates a robust opportunity for smart brands to quickly acknowledge and reply to feedback that hinders trust and loyalty.

However, troublingly, 44% reported low confidence that they would receive any response at all after submitting complaints. Implementing real-time feedback channels paired with automated confirmations of concerns received would help close gaps and reduce negative brand perceptions. Listening is only the first step – visible follow-up actions matter more.

Resolution Evaluation

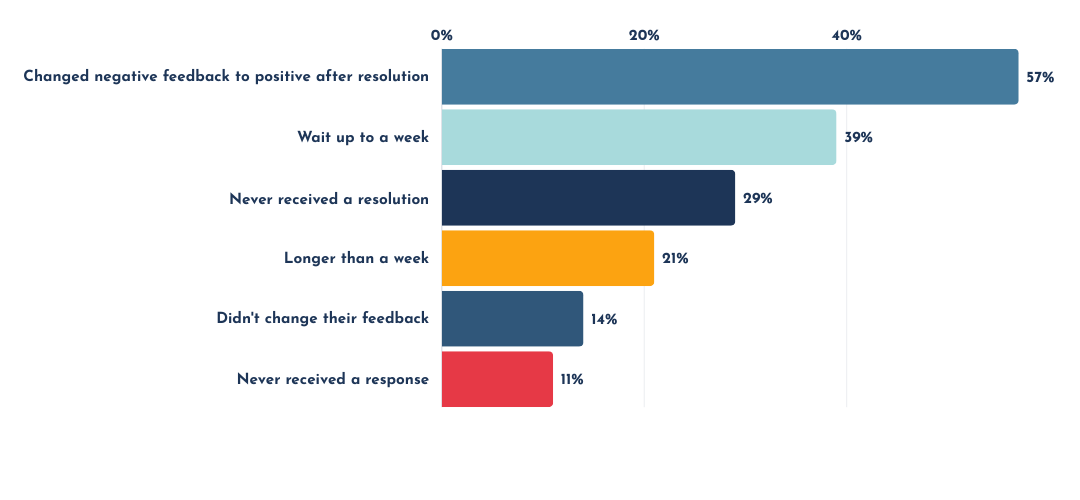

After successful resolution of customer issues, 57% of respondents reported they have changed negative feedback to positive after a satisfactory resolution. 14% indicated they did not change their negative feedback, while 29% said this question did not apply because they never received any resolution to their issue.

This highlights the pivotal role transparent communication and service recovery play in rebuilding loyalty, making response rate and efficacy top metrics to track. Unfortunately, most brands do a poor job of responding in a timely manner after a customer shares negative feedback. Only about 20% of respondents reported rapid responses within a day or within a few hours. 39% had to wait up to a week, 21% experienced delays longer than a week and 11% never received a response at all.

It’s obvious that most brands need improved response protocols to prevent lack of follow-up from compounding already negative brand perceptions.

The ranked approaches most impactful in persuading customers to return after a poor experience include:

1. Assurances of corrective actions taken to prevent similar issues

2. Full refund for the product or experience

3. Improved customer service or support

In summary, customers care more about knowing the business made actual changes in response to problems over just receiving apologies or future incentives. Transparency into concrete system improvements provides validation, accountability, and belief the same pains won’t resurface.

Seeking Brand Alternatives After Issues

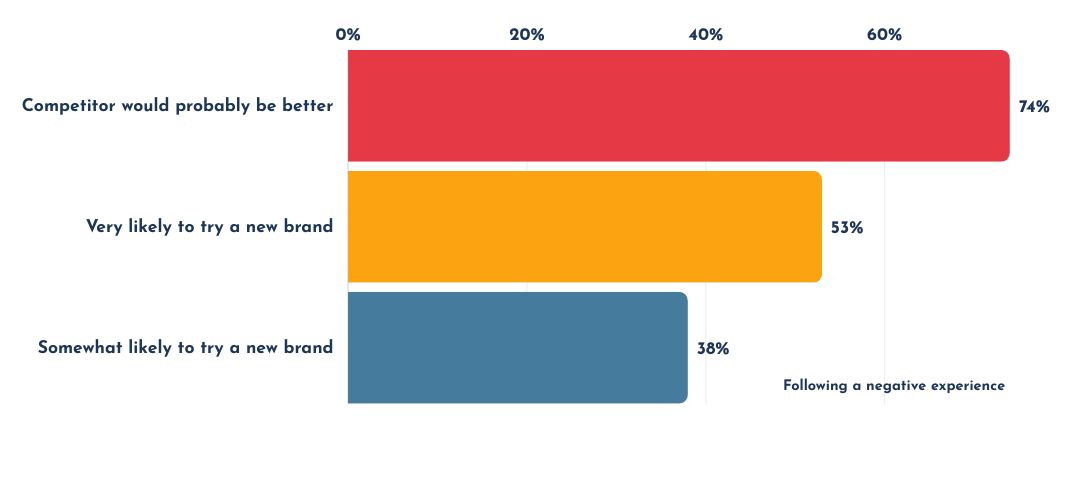

When reflecting on a recent negative interaction, 74% said they believe they would have had a better experience with a competitor brand. Additionally, over half indicated being “Very likely” and 38% “Somewhat likely” to now try a new brand over returning to one where they previously faced frustrations.

This signals damaged loyalty from customer experience problems with a lack of customer trust that the brand can make meaningful improvements, with less than 5% unlikely to explore alternative brands following a poor encounter.

Key Takeaways:

→ When uncomfortable confrontations or public complaining are the only options, more than one-third of customers will choose public complaining.

→ Indirect feedback pathways including managers, employees and/or limited surveys prevent enterprise visibility into critical improvements requested by over a third of customers

→ Acknowledge and address feedback rapidly

→ Recover loyalty with assurances of corrective actions over just incentives

→ 75% report they believe they would have a better experience with a competitor, indicating risk of permanent loss of revenue with that consumer

C. Loyalty Drivers and Exceptional Experiences

While mitigating negative feedback is crucial for damage control, brands must also actively create exceptional impressions that spark emotional connections and loyalty. Survey 3 revealed key drivers and best practices for next-level CX.

Customers Prefer an Experience Over Price and Location Convenience

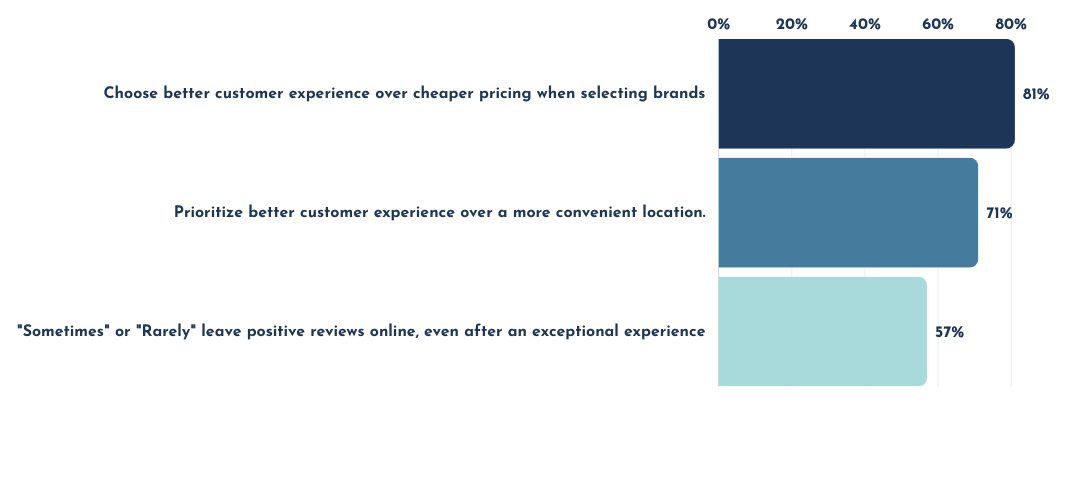

When asked directly about their loyalty behaviors, 81% choose a better customer experience over cheaper pricing when selecting brands. Additionally, 71% select a better CX over a more convenient location. This confirms that CX experience is a competitive differentiator for which customers are willing to pay more and/or forego location conveniences.

Unfortunately, 57% of these customers only “Sometimes” or “Rarely” take the time to seek out a brand online or via social media to leave a positive review, even after an exceptional experience.

This further confirms that brands must be effective and efficient at identifying and removing customer experience friction. An exceptional experience isn’t always visible to outside consumers, like negative experiences may be, but it is a direct driver of revenue and brand preference.

Brands and Industries Getting It Right

Respondents called out the following industries that are most often seen as CX leaders:

1. Hotels (63%)

2. Restaurants (60%)

3. Retail (37%)

4. eCommerce (29%)

And the following brands have the greatest positive consumer perception of their customer experience:

- Amazon

- Chick-fil-A

- Costco

- Target

- Apple

- Nordstrom

- Verizon

- Disney

This indicates that industries and brands with greater human connection, hospitality, and personalization often excel in the realm of customer experience. Companies that focus on the customer journey through an empathetic lens and identify moments that matter and ways to anticipate customer needs will benefit from increased brand loyalty and trust.

Drivers of Exceptional Customer Experiences

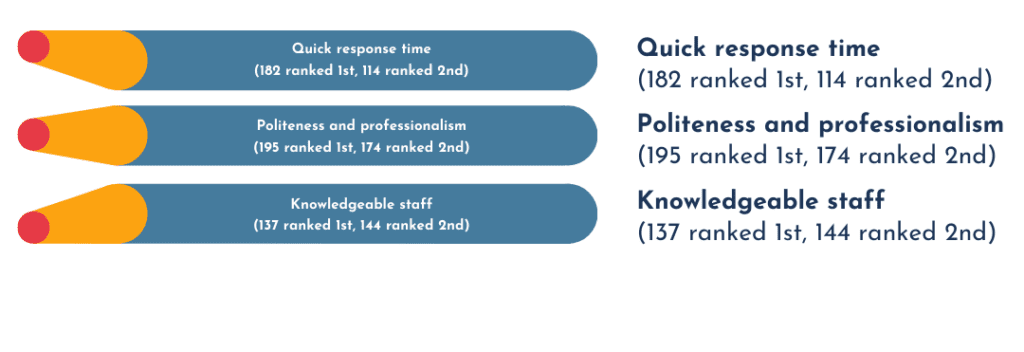

When asked to rank exceptional experience aspects in order of importance, the factors most frequently ranked first included:

- Quick response time (182 ranked 1st, 114 ranked 2nd)

- Politeness and professionalism (195 ranked 1st, 174 ranked 2nd)

- Knowledgeable staff (137 ranked 1st, 144 ranked 2nd)

This highlights that outstanding service providers are expected to offer timely solutions, respectful customer service, and expert knowledge. Failure to do so could cause a consumer to look elsewhere for their next category purchase or experience.

After establishing themselves, exceptional brands stand out by consistently leveraging their staff’s skills to address and resolve issues, fostering customer loyalty. When faced with choices among competitors, 85% of respondents stated they “usually” or “always” prefer brands who are known for providing exceptional customer experiences.

Additional drivers for exceptional experiences that were shared in open-ended responses also included:

1. Listening skills (7%)

2. Friendliness (4%)

3. Problem resolution (4%)

This emphasizes CX as an emotional platform—success comes from forging human connections through empathy and understanding before resolving issues. Surprisingly, loyalty programs were mentioned by less than 2% of respondents as part of their considerations for an exceptional customer experience.

Key Takeaways:

→ Prioritize delivering better customer experiences, as 81% prioritize CX over cheaper pricing, affirming that experiences surpass discounts as key differentiators.

→ With only 29% seeking out brands to share positive feedback, brands must actively highlight and showcase the positive feedback they receive to enhance their reputation.

→ Industries like hotels, restaurants, retail, and eCommerce excel in a feeling of personalized attention, something all brands should emulate.

→ To compete effectively, focus on swift issue resolution, adept staff, and sincere interactions.

→ Focus on the significance of listening to customers and forming an empathetic bond, recognizing that these elements carry more long-term value than loyalty point accrual.

IV. RECOMMENDATIONS

These insights uncover key areas of opportunity and best practices for improving CX approaches to drive loyalty for the modern consumer.

The key takeaways across the three surveys point to opportunities for brands to improve customer experience by prioritizing convenient feedback channels, swiftly resolving issues, and focusing on service quality over incentives. Brands should focus on a holistic approach to customer experience, leveraging feedback programs, studies, and advisory sessions to understand and address customer sentiments:

I. Launch Customer Ambassador Program-type Initiatives:

- Gather feedback that highlights constructive input and moments of emotional connection for brands.

- Motivate survey participation through simplicity, convenience, and incentives.

- Acknowledge the gaps in obtaining authentic feedback from employees/managers and online review platforms.

- Build trust and transparency through two-way communication of issue resolution.

II. Conduct Focused Feedback Studies:

- Implement periodic, robust feedback channels to capture detailed insights and understand customer behaviors and sentiments.

- Dig deeper into common issues, miscommunications, delays, or support deficiencies.

- Leverage consumer audiences for real-world insights into competitor brand preferences and opportunities to gain market share.

III. Engage Customer Advisory Board Sessions:

- Establish transparent communication channels for resolving customer issues.

- Determine ways to prioritize customer experience over pricing and location convenience.

- Identify detailed friction points in your brand’s customer experience that get in the way of loyalty and preference.

- Determine ways to highlight and showcase positive feedback received to enhance brand reputation.

These types of tools provide brands with visibility into pain points and enable two-way dialogue with customers to co-create solutions. Prioritize building trust, transparency, and proactive communication to mitigate negative experiences and foster loyalty. Swift issue resolution, knowledgeable staff, and sincere interactions are pivotal in creating exceptional experiences that differentiate brands in the competitive landscape.

By launching continuous customer experience listening programs, brands can monitor key CX metrics, validate improvements, and earn customer trust and loyalty through transparency. Ultimately, human connection and empathy play a crucial role in building long-term customer relationships, making them prioritize the brand over pricing or location convenience.

Learn more about robust market research services that launch closed-loop listening programs for brands to turn insights into action, including facilitating customer ambassador polls, focused feedback surveys, and customer advisory boards.